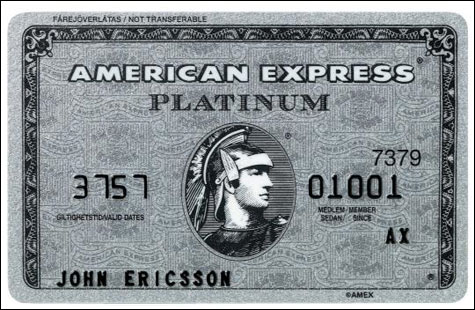

American Express Platinum Card – Graduate review

May 3, 2008

The American Express Platinum MoneyBack Credit Card is at the moment one of the leading cashback cards on the market, offering up to a generous 5% cashback for the first three months of spending up to a maximum £4,000. As a graduate you could could earn up to £200 on this card just by spending your hard earned cash!

The American Express Platinum MoneyBack Credit Card is at the moment one of the leading cashback cards on the market, offering up to a generous 5% cashback for the first three months of spending up to a maximum £4,000. As a graduate you could could earn up to £200 on this card just by spending your hard earned cash!

After the initial period three month period, the card offers a tiered cashback rate, so depending on how much you spend a year, as a graduate you will be able to earn between 0.5% and 1.5% cashback.

This card is great for graduates earning over £20,000 and provides you with all the perks associated with American Express.

This card does not come with an introductory or balance transfer deal, so will not be useful if you are looking to borrow on the card. But this is leveraged by the generous cash back amount available.

Find out more about the Platinum American express here.

Best Graduate Accounts for 2007/2008

May 3, 2008

When it comes to graduate banking, Lloyds TSB and the Royal Bank of Scotland offer graduates a special interest-free overdraft for three years; and have great 0% overdraft limits. The interest free maximums are £2,000 in year one, £1,500 year two and £1,000 year three.

With Lloyds TSB’s graduate account the limits are guaranteed while RBS’ graduate limit is approved on a case-by-case basis. Yet to counter that, if you need to borrow over the limit, and its agreed RBS is cheaper at around 10% compared to Lloyds 16%; plus it also pays higher in-credit interest. Though if you do need more borrowing, in either case it is likely to be cheaper to get a special graduate loan.

As the difference between the is subtle, go for whats most convenient for you.

Do you have a Halifax or Bank of Scotland Student Account?

Although they don’t offer graduate accounts per say, most existing Halifax or Royal Bank Of Scotland student accounts holders can receive up to £2,750 interest free as part of their overdraft for the first year of graduation as an extension of their student account.

Therefore if you’re with either the Royal Bank of Scotland or Halifax, stick with them this year, then switch to the best graduate account the next. There is always a chance such good limits to switch to won’t be offered next year, but graduate account deals have been consistently improving with most banks.

Graduate guide to renting a property

May 3, 2008

As a recent graduate, you will be looking for a place to live, and chances are you will be starting off by renting a flat or studio. So what should a graduate look out for when viewing a rental property?

Below is a thorough guide to the different things you should keep in mind when viewing a property to let.

1. Before viewing

Always try to go to a property viewing with a friend, it is not only safer but it also means you will get a second opinion, and more chances to pick out flaws you may not have seen. If you want to be even more careful, let friends or family know where you are going in case and keep a taxi number for the way back.

2. Viewing the flat: Take your Time

Estate agents might try to rush you through a viewing, especially during peak hours. In our current high demand rent market, this is your only opportunity to judge the place, so don’t be afraid to take your time and ask as many questions as possible. Remember that Estate agents will appreciate a curious buyer, who knows what they want.

Try and prepare questions before you view your property, you will find that the more properties you view the more questions you will be asking based on previous experience. A good idea is to draw up a check list to take along, and to bring in a notepad to take notes.

If you sign the lease you will be doing so based on your viewing, meaning if you didn’t check the water pressure or notice the lack of radiators, there wont be a lot you can do about it once you’ve signed the contract.

3. The Local Neighboorhood

See if you can show up slightly early to allow yourself a look around and get a feel for the area. Try and revisit at different times to check whether the area is well-lit? If its a safe environment or will you feel isolated and vulnerable?

Find out about the local Amenities: Shop, Tube stations, parks, cashpoints, bus stops, banks and parking are all very important factors to look for.

Availability of public transport is one of the most important points: How far is the nearest stop? How frequent and reliable is the tube or bus service and does it operate in the evenings and at weekends? Many stations close earlier on weekends, and this might impact your socialising in the evenings or taxi expenses! How much is a monthly season card – don’t forget to cost the commuting factor into your monthly outgoings.

4. Viewing the Property & its condition

Take time to look for signs of damp in all rooms – usually telling signs are a musty smell, flaking paint, loose wallpaper, spots on the walls.

Look for any signs of mice infestation by looking for droppings, traps or poison baits – don’t forget to check for this in ground floor cupboards.

Is there central heating, and do all the heaters and radiators work? If the property doesn’t come with central heating is there an alternative source such as storage heaters/electric heating? Is central heating included in your rent?

Is there double glazing in your new flat? If not, check if the area is quiet. Not having double glazing means sleepless nights on busy streets and higher heating bills.

Are the general decorations to your taste? Look at paint, wallpaper, carpets, floorboards are they in reasonable condition and check if you would be allowed to carry out any decorations if not?

Check for space, especially if you plan on moving a lot of stuff from home. Is there adequate storage space in the property? Does the kitchen have enough surface & storage space for your needs?

Finally we would recommend as a graduate that you visit the property more than once and at different times of the day to check that they are happy with the area. Other than that, happy flat hunting.

Student loans in the UK

May 3, 2008

The content of this section is related to student loans for those who started higher education after 1st September 1998. If you started before this date the situation is different and, thankfully, somewhat simpler. Details on this type of loan (and futher details on post 9/98 loans) may be obtained from the Student Loans Company.

When did this type of student loan start?

Income contingent loans started in August 1998 with the introduction of tuition fees.

When do I have to start repayments?

Repayments don’t start until the April after you graduate. Even then you won’t have to start repayments until you are earning above £10,000.

How is this paid?

This will be taken out of your salary at source in the same way as PAYE deductions.

How can they take money from my salary?

You provided your National Insurance number when applying for the loan.

When will I be informed?

In February after graduation the student loan company will write to you to let you know how much you owe.

Then in April you will receive a monthly repayment schedule. The inland revenue will be notified and these payments will be deducted from your salary.

What rate of interest will I be charged?

The interest rate is varies and is linked to inflation. This interest starts the day you get your first loan. For current interest rates see the student loans company.

What is the repayment rate?

The default rate is 9% on all income above £10,000. This may be increased by contacting the Student Loan Company.

Myth: My student loan will be automatically deducted from by wages at the appropriate level in the same way as my PAYE deductions.

Fact: Unfortunately neither your employer nor the Inland Revenue can be relied upon to be right in every case. It is important that you know how much you should be paying.

Example: Possible Tax Overpayments.

Overpayment may occur on switching employers. When leaving an employer you will be given a P45. This shows your employer how much tax you have paid over the previous year. This P45 does not show the amount of student loan repayments made whilst with your previous employer. Then when you receive your P60 at the end of the tax year any previous payments will not show on it.

Ultimately your new employer may tax you on gross salary without repayment deductions.

Solution:

Check how your loan payments have been shown on your payslip. Keep all payslips as proof of payment and earnings. Always compare March payslip with April P60.

If you establish you have been paying too much tax, contact the Inland revenue straight away. They will be able to calculate how much tax you should have paid, and how much you have. If there is a deficit you will receive a rebate.

For more information see the students loan company.

Welcome to graduate finance

May 2, 2008

Welcome to graduate finance, your guide to all things important to recent graduates.